does amazon flex give you a w2

You expect to owe at least 1000 in tax for the current. Amazon Flex is a delivery service gig that allows you to make money by delivering packages for Amazon.

Amazon Flex Driver How To File Your Taxes In 2022 1099 Nec Youtube

Pickups from local stores in blocks of 2 to 4 hours.

. No matter what your goal is Amazon Flex helps you get there. This means youll use your own vehicle to make. I work for Amazon Flex and there was a point where I got hired for the warehouse Jan 2020.

100 of last years tax from Form 1040 Line 24 - Line 32. You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. So weve compiled a list of Amazon Flex driver tips and tricks that will keep your paychecks on the high side and help you enjoy your time on the road.

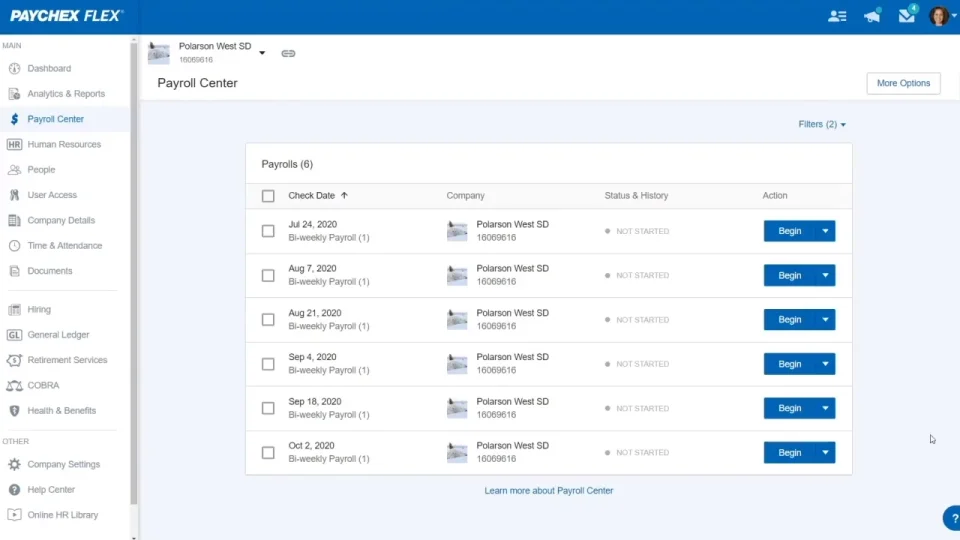

As an Amazon Flex driver youre classed as an independent contractor sometimes called a self-employed driver. Amazon Flex Drivers are considered 1099 non-employee workers which is a separate taxpayer status from the classic W-2 salaried employees who work for someone else. This is great except that this is the 3rd party that her current employer uses.

The Amazon Flex App. W2 Bundle with TaxRight 2021 Software Formerly known as TFP 50 W-2 6 Part Tax Forms for Employees QuickBooks Compatible Laser Forms Includes 2021 TaxRight Software Disc and. Flex drivers use this.

In Oklahoma City DOK1 they wont let you pick your route. The first is that your team could lose possession of the ball and the other team could score. If you dont have other tax withholding that covers your tax liability you will need to make quarterly tax payments.

If you have a W-2 job. Its similar to DoorDash or Grubhub where you can pick up work as you. How many packages does Amazon flex give you.

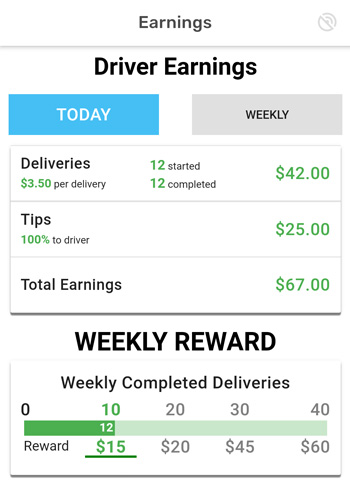

Amazon Flex does not take out taxes. The Amazon flex driver app is the primary platform of Amazons delivery partners program. Answered February 10 2020.

They also send flex drivers 30-45 minutes outside of the city. Click the Amazon Flex app 3. Because of this I lost the ability to work Flex which paid better so I.

If this happens it is usually because the. Amazon says that the W2 is available online through their 3rd party company that handles it. Only available in limited areas these deliveries start near your current location and last from 15.

Driven by always being there for storytime. Disable the settings for Freeze when in background and Automatically optimize when an abnormality is detected Xiaomi Redmi battery device settings. This is where all the magic happens.

90 of your current year tax hard to know if you vary your Amazon Flex hours. Lets Drive Or download the Amazon Flex app Start earning. Most drivers earn 18.

Noteif your AGI Line 11 was greater than.

23 Apps Jobs Like Amazon Flex To Earn Money Making Deliveries Appjobs Blog

Amazon Flex Driver How To File Your Taxes In 2022 1099 Nec Youtube

Jmaz Versa Flex Bar All In One Lighting System W 2 Movers And Fx Bar

Frequently Asked Questions Us Amazon Flex

![]()

Frequently Asked Questions Us Amazon Flex

The Definitive Guide To Amazon Flex Pay Ridester Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Instant Smile Comfort Fit Flex Teeth Uppers And Lowers W 2 Extra Beads Walmart Com

Wonderfold Wagon W2 Elite Review Fathercraft

Allied Brass 16 In L X 8 In H X 5 In W 2 Tier Clear Glass Vanity Bathroom Shelf In Antique Brass Ns 2 16 Abr The Home Depot

How To Pay Taxes For Amazon Flex R Amazonflexdrivers

Costway 16 Pressure Washer Surface Cleaner Attachment W 2 Extension Wand Cl11872 The Home Depot

Payroll Services Online Payroll Software Paychex

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Want To Deliver For Gopuff Here Are The Driver Requirements And A Job Overview Ridesharing Driver